Last year, The Urbanist covered a Master Builders Association of King and Snohomish Counties (MBAKS) report suggesting that townhouse development in Seattle might be dropping off a cliff. However, nine months later, data from the City of Seattle shows that townhouse production set a record in 2021 and that 2022 is outpacing many previous years as well.

MBAKS reported a decline in project applications from 450 in 2018 to 289 in 2020 and then anticipated only 139 projects in 2021. The report goes on to argue policymakers should be alarmed and the Mandatory Housing Affordability (MHA) program may be a primary culprit. MHA requires new development to build below-market housing on-site or pay a fee, potentially increasing construction costs. The policy was designed to offset this cost with increased building height, but townhome builders often argue the market doesn’t want four-story townhomes that MHA’s extra floor of height allowance made possible.

What was built

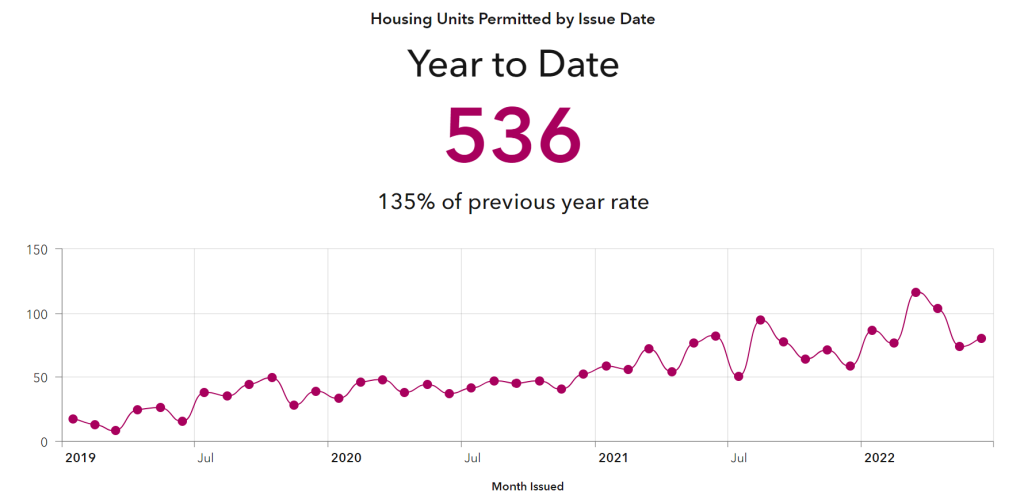

A narrative about declining townhome production is complicated by current development numbers. Project applications provide the most advanced leading indicator of construction but they don’t always translate to what is built. At the time of application, unit counts may be wrong. Building typologies may also be reclassified. Overall the number of projects may not be indicative of the number of units built. Representatives from Seattle Department of Construction and Inspections (SCDI) cautioned against drawing strong conclusions from project applications. But still, project applications are one of the few leading indicators we have and the trend is very clear, project applications are down.

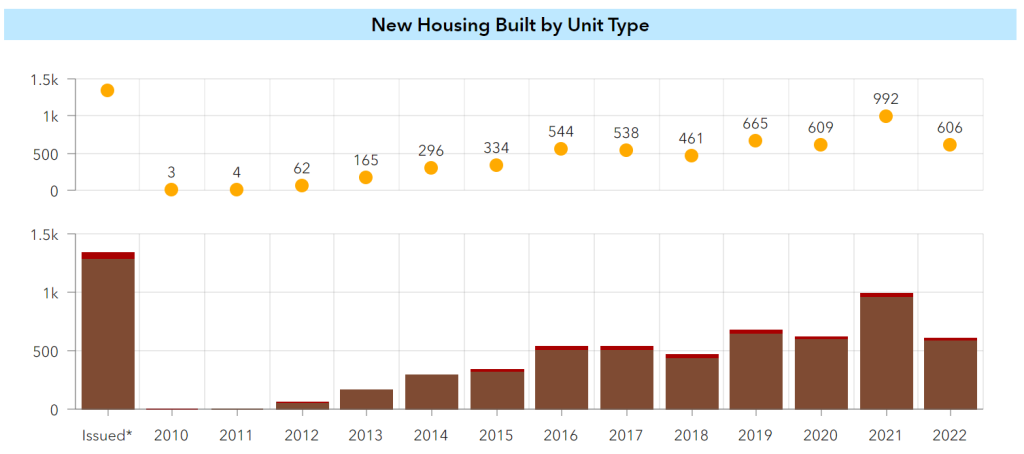

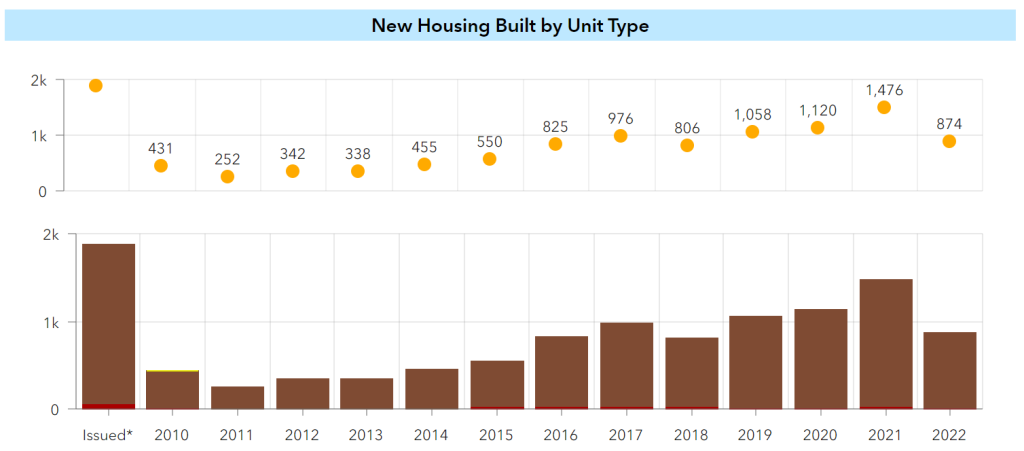

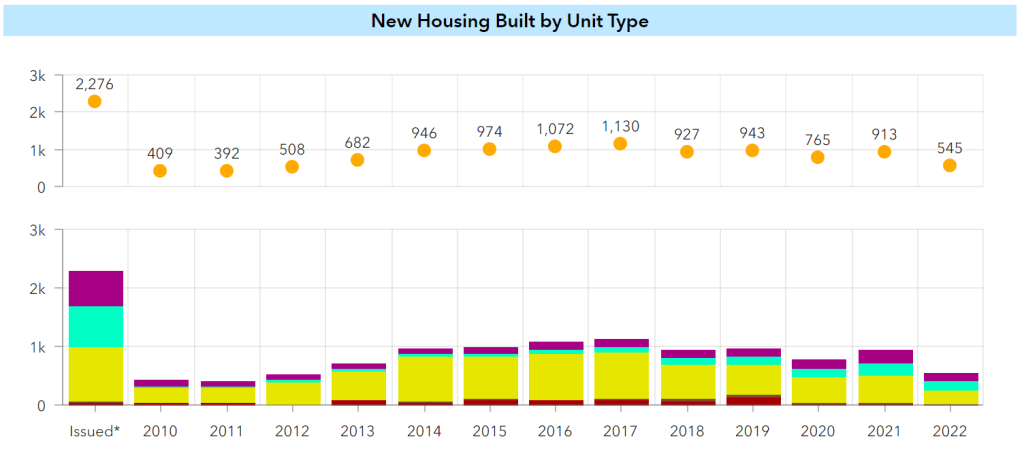

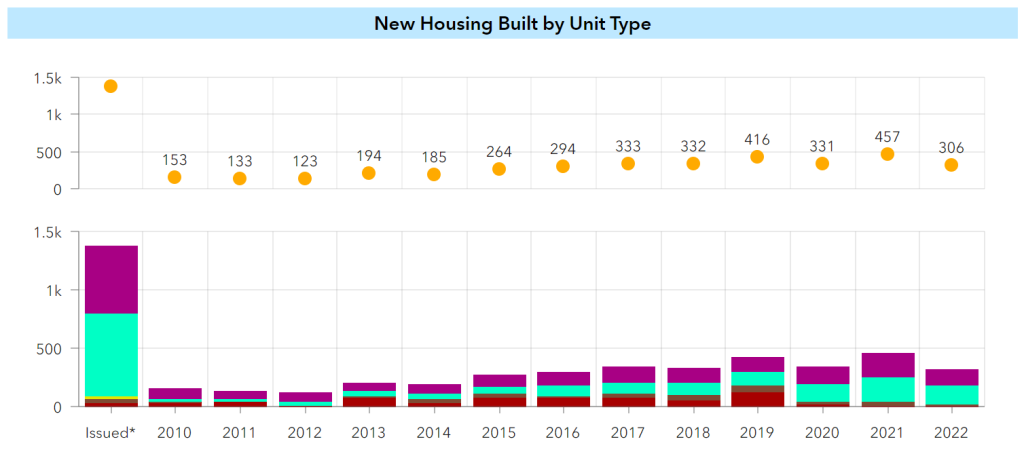

Looking at the city’s reporting dashboard tells another story about more immediate trends.

2021 was a huge year for townhomes, nearly 50% more townhomes completed than any other year. This appears to have complicated the narrative that MHA is to blame for the project application decline. 2021 numbers include many projects permitted before MHA implementation which may account for the peak, builders potentially rushing to submit permits. Still 2022 will have many fewer applications filed prior to MHA, yet this year is on pace to see more townhomes built than any year besides 2021 and 2019.

Caution is warranted. We may still see a slowdown as predicted. Cameron McKinnon, a Seattle townhome builder and partner with Confluence Development LLC, seeing similar indicators and said, “I’m expecting the beginning of the downward trend for unit delivery this year,” suggesting builders have about a 2.5 to 3 year window from application to listing. This timeline suggests a decline at the end of 2022 but also makes it harder to disentangle the causes. MHA was put into law in March 2019. Since 2019 we’ve seen the pandemic, dramatic changes in construction costs and additional land use changes, such as the easing of ADU restrictions. Plus, interest rates have recently jumped, which shrinks the buying power of prospective townhome owners.

More than one source suggested townhome builders could be switching to other products.

“A lot of builders have shifted product types from building townhomes to building ADUS and DADUs,” McKinnon said. Issued permits suggest this is the case, trending way up for ADUs and DADUs since 2019.

But overall, detached home and accessory unit production is lower than prior to MHA’s implementation. This is true even in 2021, when a record number of total units were built. It appears like there’s a downward trend for these types of homes even though many are in areas exempt from MHA. The policy still doesn’t cover areas formerly designated as single family zoning, which may make those areas more attractive for development comparatively.

It’s hard to prove a counter-factual: without MHA would there have been more townhome construction? Aliesha Ruiz, Seattle Government Affairs Manager at MBAKS, reiterated what she’s hearing and what MBAKS reported. Referring to the townhome builders represented by MBAKS, she said “a large percentage of them have pivoted from building townhomes to buildings ADUs and DADUs because of MHA.”

It’s undeniable that many townhomes completed in 2021 were permitted before MHA implementation. But many weren’t and even fewer in 2022 were permitted before MHA went into effect.

But the general understanding from builders is clear. Ruiz said, “They tell me all day every day how it’s impossible to build townhomes.” And since the report was published in 2021, MBAKS has continued to track permit applications, noting the trend has continued.

SDCI provided project application data through April of 2022 to The Urbanist, and it suggested townhouse applications might be up from the 2021 trough but the numbers are still well below their peak. Any potential uptick, is too small to see a trend. Regardless, there appears to be general concern about townhouse production. New legislation was voted out of committee last week to further ease townhome production though it didn’t address MBAKS’s concerns about MHA requirements.

Overall, a dramatic decline in townhouse production hasn’t materialized yet, despite the leading permit indicators. The summer of 2023 will likely provide definitive data. Additionally, overall housing production is up since MHA implementation. Townhouse production set a record in 2021 and 2022 appears to be outpacing many years prior to MHA implementation.

Owen Pickford

Owen is a solutions engineer for a software company. He has an amateur interest in urban policy, focusing on housing. His primary mode is a bicycle but isn't ashamed of riding down the hill and taking the bus back up. Feel free to tweet at him: @pickovven.