Councilmember Teresa Mosqueda unveiled a big business tax proposal called “JumpStart Seattle” today that would raise $200 million per year from the wealthiest companies in the city. A handful of business, labor, and nonprofit leaders joined Mosqueda, who chairs the Budget Committee, during the announcement and voiced support.

While the proposal would raise less money that the “Tax Amazon” proposal backed by Councilmembers Kshama Sawant and Tammy Morales, the coalition behind it appears broader. Unlike Tax Amazon, Mosqueda’s proposal is not an emergency ordinance, so it can be passed without Mayor Jenny Durkan’s signature via a veto override. It needs six votes.

“Everybody who we’ve spoken to over the last couple of months had come to same conclusion,” Councilmember Mosqueda said. “Our community is hurting. Our economy is tanking. We cannot wait for the Feds or the State to step in. We have to act now to help Seattle.”

Seattle University professor Sara Rankin endorsed the plan’s emphasis on supportive housing and extremely low-income housing, as did Marty Kooistra of the Housing Development Consortium. Union support appears strong, with SEIU 775 (long-term care workers), UFCW 21 (the largest private sector union in the state representing grocery and retail workers), and Seattle Local 86 (ironworkers) standing behind the plan at the announcement, and more unions likely waiting in the wings. The plan includes assistance for undocumented workers–who don’t qualify for most forms of federal assistance–which helped earn the endorsement of immigrant justice group One America.

JumpStart Seattle includes a 10-year sunset clause, which Councilmember Mosqueda’s office has said was instrumental in winning some business support. Richard de Sam Lazaro of Expedia spoke in favor of the effort, as did Steve Hooper of Ethan Stowell Restaurants.

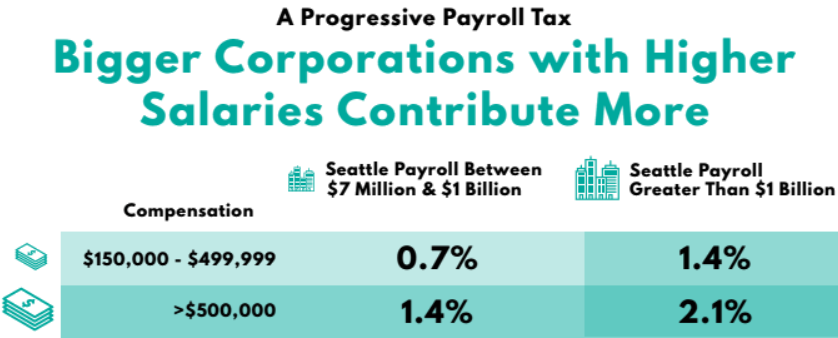

The tax is weighted toward companies with the most high-paid workers.

In another departure from Tax Amazon, JumpStart Seattle is a multi-tiered payroll excise tax. The first tier kicks in at the same point–companies with $7 million or more in payroll–but the rate is 0.7% on any employee making more than $150,000 and 1.4% on anyone making more than than $500,000. The second tier kicks in for companies with more than $1 billion in payroll–their tax rate is 1.4% for employees making more than $150,000 and 2.1% for employees making more than than $500,000. It’s not clear how many companies are in this higher tier, but Amazon would be among them.

By contrast, Tax Amazon sets a flat tax rate of 1.3% on all payroll at companies with at least $7 million in payroll–which is about 800 companies. By doing so it, would raise upwards of $500 million annually.

By targeting only big salaries and exempting grocery stores and governments, JumpStart Seattle tailored the tax narrowly hoping to protect working-class jobs while generating revenue from businesses that continue to boom during Covid. Amazon would by the top payer of the tax, and its revenues are up significantly thanks to the boom in online shopping.

Spend plan centers affordable housing, Covid relief

The spending plan also differs from Tax Amazon in some ways. JumpStart Seattle isn’t relying on interfund loans from levies, but does tap the emergency reserves to fund first-year priorities and plug the immediate budget hole created by the Covid recession, which is estimated at between $210 million and $300 million this year. The tax then replenishes the emergency fund in following years as proceeds come in starting in 2022.

In year one of the spending plan, “40% of the emergency money spent by the city would go toward housing assistance, including help with rent, expansion of homelessness prevention services and money for homeless shelter providers,” David Kroman reports. “Twenty percent would go toward direct assistance for immigrants and refugees; 20% toward helping small businesses; 15% to expand emergency food vouchers; and 5% toward administrative costs.”

In year two of the spending plan–2021–the tax focuses on backfilling City programs facing budget shortfalls due to the Covid-triggered financial crisis. It would also continue to provide food assistance and small business support.

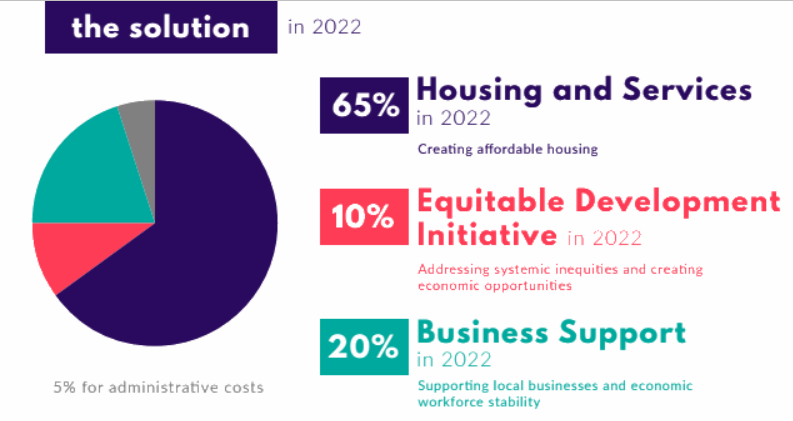

In year three of the spending plan, the housing mission comes front and center. About $150 million (or 75%) would be dedicated to affordable housing creation–most of which is aimed at households making 30% or less of area median income. Some 50% area median income (AMI) housing will also be funded if in conjunction with 30% AMI housing. Of the housing funds, $20 million per year is earmarked for the Equitable Development Initiative (EDI) which funds community-driven projects in historically disadvantaged communities of color. Often housing is combined with small business incubation and social services–examples include the Southeast Seattle Economic Opportunity Center planned across from Othello Station and a food business incubator in Rainier Beach. The remaining $50 million or so in annual spending would go towards economic recovery efforts and a just transition to a green economy.

Mayor and Chamber staying mum

Reporters who have much better luck getting comments from them failed to get comment from Mayor Durkan, Amazon, and the Seattle Metropolitan Chamber of Commerce on Mosqueda’s new tax proposal. Amazon and the Chamber campaigned hard to repeal the 2018 head tax and then invested heavily in unseating progressive Seattle City Councilmembers and electing pro-business moderates to open seats. Those efforts largely failed with the exception of District 4, where Chamber-endorsed Councilmember Alex Pedersen prevailed.

Councilmember Pedersen came out hard against the Tax Amazon effort, favoring austerity cuts instead. It will be interesting to see if he maintains his hard-line stance against big business taxation or if he comes around. Councilmembers Sawant and Morales have also declined to comment on the alternative proposal so far, but obviously support the idea broadly since they have proposed an even larger version of it. Comments in the Budget Committee meeting Wednesday afternoon should offer some hint where councilmembers stand.

Business support was also pretty tepid for a countywide payroll tax effort earlier this year, which needed enabling legislation in the state legislature–that bill petered out. The tax, however, would have raised about $120 million annually in King County. The 2018 head tax would have raised about $47 million annually in Seattle. In beating back smaller measures, big business only seems to be inviting larger ones.

Doug Trumm is publisher of The Urbanist. An Urbanist writer since 2015, he dreams of pedestrian streets, bus lanes, and a mass-timber building spree to end our housing crisis. He graduated from the Evans School of Public Policy and Governance at the University of Washington in 2019. He lives in Seattle's Fremont neighborhood and loves to explore the city by foot and by bike.