From February 2018 through January 2019, Washington state tested out a possible replacement program for the gas tax known as the “Road Usage Charge” (RUC). The test simulated how an RUC would perform for participant drivers by comparing savings or additional costs of the RUC to the gas tax. About 2,000 participants chose to opt into the pilot program, which was administered by the Washington State Transportation Commission (WSTC).

A report on the test program was released earlier this month, highlighting how the program was structured and various findings, such as lessons learned, legal considerations, and equity and operational issues. Now the WSTC is planning to issue final recommendations today at its December 17th meeting. Those recommendations, however, could perpetuate Washington’s deeply unbalanced transportation priorities, which lavish attention on cars while transit, walking, rolling, and biking get minimal attention.

Roads-only recommendation is recipe for climate delay

In October, 15 preliminary recommendations were issued by the WSTC on implementing a road usage charge. These range from privacy protection to developing transition scenarios. But one recommendation that would greatly restrict how RUC revenue can be spent has caught the ire of climate action and multimodal transportation advocates. (Update: The recommendation was retained in the final vote on the recommendations, but Commissioner Hester Serebrin did attempt to eliminate it.)

That last recommendation would apply the principles of the 18th Amendment of the Washington State Constitution to revenues derived from the RUC. The amendment deals with how gas tax revenues may be spent, and though arguably misapplied, it says that these revenues must be used for “highway purposes.” The term itself is broadly and vaguely defined in the constitution.

In recent decades, state legislators have been unwilling to test the bounds of what constitutes “highway purposes” by allocating funding toward transit service, many multimodal investments, and construction of urban rail. Who’s to say those are not highway purposes?

While there is general consensus that the Washington Supreme Court would be deferential in accepting an argument that virtually any expenditure of gas tax revenue for varied transportation investments is acceptable, it seems unlikely that state legislators will test the waters anytime soon, especially with suburban and rural legislators’ eyes set on building highway projects in their districts and handwringing over I-976 uncertainty.

Restricting use of revenues would be a mistake, RUC could offer equitable options

Tying RUC revenues to a constitutional amendment understood–whether wrongly or rightly–as only benefiting car infrastructure would be a historic mistake. This is why a coalition of advocates, such as Sierra Club, Futurewise, Transportation Choices Coalition, and Washington Environmental Council, are urging the WSTC to reconsider this recommendation. According to their letter, they are asking the WSTC to “not restrict revenue to ‘highway purposes'” and “[s]et a progressive rate structure and ensure implementation considers the needs of communities that have been marginalized.” They also note that the “RUC must be implemented strategically and ensure it accounts for broader environmental and other impacts.”

On the first charge, they make several salient points:

A RUC presents an opportunity to help fund our transportation system in a more financially sustainable way. Multimodal investments present benefits to the overall population and to the environment in terms of increased safety, reduced air pollution, and mitigated stormwater runoff. While road usage by passenger vehicles necessitates the need for ongoing road maintenance, funding that helps mode shifts to transit, walking or biking benefits our roadways overall by way of less wear and tear and reduced congestion, leading to fewer maintenance needs and fewer demands for costly road expansions.Restricting RUC revenues to the motor vehicle account ignores the interconnectedness of our entire system.

That is not to say that revenue should not be used for highway purposes. Our existing roads must be safely maintained, and we have a legal mandate to fix culverts. If adopted, a RUC must provide revenue for preservation, while also contributing to other multimodal transportation needs. We strongly disagree with WSTC’s current suggestion to restrict RUC revenues to highway-related expenditures, andwe urge the Commission to rethink this recommendation.

The coalition of advocates also see the RUC as a way to become more progressive than a gas tax. “The gas tax, in addition to being a declining source of revenue absent continuous rate increases, is also a regressive revenue source since those with lower incomes are likely to pay a higher percentage of their income,” they state. “A RUC, if structured equitably with a progressive rate structure, presents the opportunity to remedy both of these issues.”

Why a road usage charge

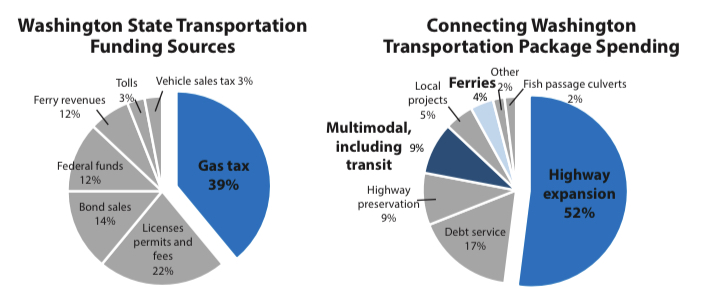

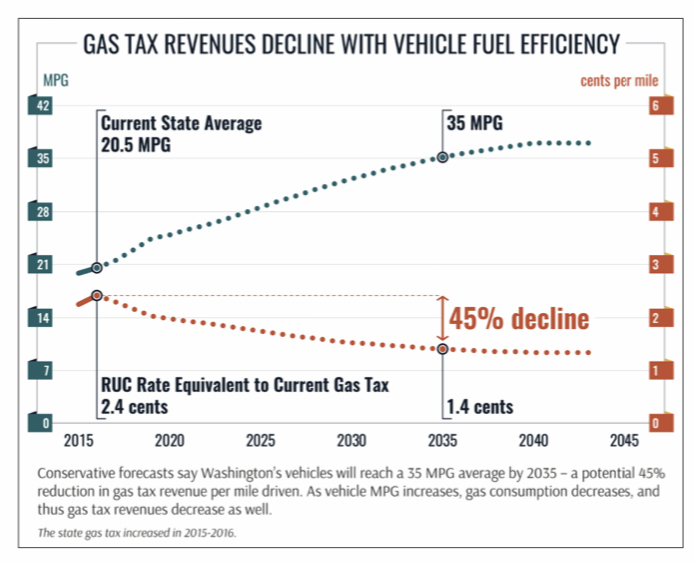

Washington is pursuing an RUC because the gas tax is unable to keep up with increased fuel efficiency of newer vehicles and widespread adoption of electric vehicles. As vehicles become more efficient, the gas tax must be increased to hold revenues at their intended levels since systemwide the average number of miles a car can go on a gallon increases.

Raising the gas tax, however, does put more tax pressure on owners of older vehicles since their mileage per gallon does not improve, leading to an effective tax increase on a per-gallon and per-mile basis. This is arguably an inequitable impact to many lower-income car owners even though it is a partially Pigouvian tax and market signal to operate more efficient vehicles, which is a social and environmental positive.

There are two other major problems with the gas tax. One is that it does not reach car owners who operate electric vehicles. To partially remedy this, the state now charges an annual vehicle registration fee specifically on electric vehicle owners to pay for transportation investments. The other major problem is that the gas tax does not increase with inflation. As a result, the flat gas tax loses its purchasing power every year until it is unilaterally raised through new legislation.

Under the RUC simulation by the WSTC, participant drivers received invoices showing whether or not the RUC saved or costed more than the gas tax for the mileage driven. This was tailored to the type of vehicle a driver used. The RUC’s baseline charge was 2.4 cents per mile, which if comparing to the gas tax would break even at 20.6 miles for drivers who get average gas mileage at that level. For reference, Washington’s gas tax is currently 49.4 cents per gallon.

Participants were offered several different means to report their mileage. These included manual and digital options, such as plug-ing GPS devices, odometer readings at vehicle licensing offices, and smartphone app. All of these come with their own tradeoffs to the user in how much work it is to report mileage, level of privacy, and whether or not mileage can be excluded from out-of-state travel. For the state, there is a variety of tradeoffs in implementation for each reporting option tested, which the report digs into.

Will an RUC replace the gas tax? Time will tell if that is the solution Washington ultimately chooses. But for now, early policy direction is in the hands of the WSTC. And while the WSTC’s meeting on recommendations is happening today, you can still send your feedback on the program and final recommendations.

Stephen is a professional urban planner in Puget Sound with a passion for sustainable, livable, and diverse cities. He is especially interested in how policies, regulations, and programs can promote positive outcomes for communities. With stints in great cities like Bellingham and Cork, Stephen currently lives in Seattle. He primarily covers land use and transportation issues and has been with The Urbanist since 2014.