Amazon announced yesterday that the company is planning the search for a second headquarters in North America where it promises as many as 50,000 jobs. This launched a bout of hand-wringing from Washington state politicians worried the tech giant would bolt on us, reassuring themselves and Amazon that Seattle still have the urban assets to please tech behemoths that increasingly drive the economy.

Amazon now has its pick of suitors with cities already falling over themselves to woo Amazon with a proposal for “HQ2” as they’re branding their second “full equal” headquarters. In the heat of the chase, the question is what does a city get out of an Amazon headquarters? Upwards of 50,000 jobs are nice, but what are the wider implications? Seattle has some insight.

First, here’s what Amazon’s proposal pledges: an average annual total compensation exceeding $100,000 for those up to 50,000 full time employees. Moreover, “The Project is expected to have over $5 billion in capital expenditures,” the proposal said. “Amazon estimates its investments in Seattle from 2010 through 2016 resulted in an additional $38 billion to the city’s economy–every dollar invested by Amazon in Seattle generated an additional $1.40 for the city’s economy overall.”

Free Advice

No advice rings louder now than: Prepare for rapid housing growth and zone like you mean it. Adding 50,000 high paying jobs to a metropolitan area has far reaching effects. Recruit enough construction workers to handle the building boom. At the municipal level, the city that becomes HQ2 would also be wise to increase staff in its permitting offices and streamline the approval process so office and housing construction can keep pace with demand. Invest in public housing so that low-income residents don’t get displaced in the midst of the boom.

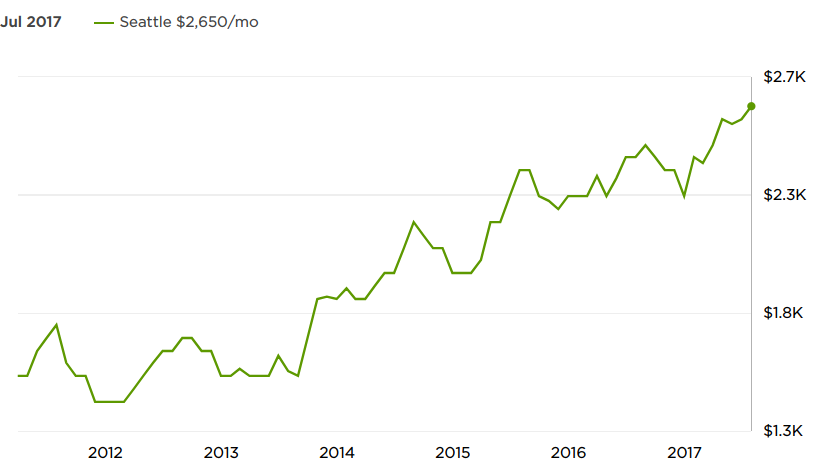

Not building quickly when facing Amazonian demand is sure to lead to see skyrocketing housing prices and similar for office space and retail space. Median home values in Seattle have doubled since 2012, when they were at $355,000. Seattle’s median home value is projected to hit $700,000 this month. Seattle’s median rental listing jumped from $1,500 in 2012 to $2,650 by Zillow’s last estimate. The median rent is likely to climb somewhat even if cities build rapidly since Amazon workers tend to lease housing above the median, but doing so will prevent runaway price escalation and displacement.

Cities must also prepare their transportation networks for growth. Seattle’s highways have buckled under the stress of so many commuters, but earlier investment in transit could offer an alternative and forestall the worst gridlock. Since Amazon is planning to scale up quickly, the winning city must also plan immediate improvements rather than relying on big long-term fixes. Bus rapid transit can tide a transit network over as light rail or subway lines are expanded. Cities would also be wise to move quicker than Seattle has in rolling out a Basic Bike Network. Walking and bicycling are the lowest impact modes and shouldn’t be forgotten.

Expect Class and Racial Tension

The other thing Amazon’s suitors should expect is that not all of their citizens will greet Amazon’s arrival as gushingly. Folks with either little interest or little opportunity to work in tech will struggle to see the direct benefit to them. People of color may have a hard time envisioning the Amazon boom benefiting them. In 2014, Ryan Mac broke down the statistics Amazon released showing that Amazon’s workforce and especially its management skews white and male.

“Amazon, which employs more than 88,400 around the world according to its careers website, noted that its workforce was, unsurprisingly, composed of most white males,” Mac said. “Some 63% of its ‘Amazonians’ were male, while white employees made up 60% of the workplace. Those percentages were even higher for employees in managerial positions, of which 75% were male and 71% were white.”

Meanwhile, Blacks and Hispanics were a relatively minuscule portion of Amazon’s workforce in 2014.

Amazon’s report was troubling, though not unexpected. Blacks made up 15% of Amazon’s global employees, but only 4% of its managers. Hispanics comprised 9% of the total workforce and only 4% of manager positions. Asians were the only race and ethnicity group to have a larger percentage of managers (18%) as compared to its overall percentage of workers (13%). Women represented 37% of the workforce and 25% of the total number of managers.

The problem is even worse at the top of the tech industry. “Shortly after Amazon released its employment figures, Rainbow Push issued a statement noting its displeasure with the results,” Mac said. “It also released an analysis of 20 boards of tech companies including Amazon, Apple, Yelp, Google and Facebook, which showed that out of 183 board members, only three were black and one was Hispanic.” Amazon may be working to correct these equity issues, but for the time being some will feel left out. Cities may want to take steps to ensure all of its citizens share in the opportunities HQ2 brings.

HQ2’s Impact on Seattle

Worried that Amazon was sending a message to Seattle that it wanted more out of its hometown, Seattle leaders wondered how to keep Amazon happy. Heather Redman, co-founder of venture capital firm Flying Fish and the incoming Chair of the Seattle Metropolitan Chamber of Commerce, told Geekwire, “It’s never too late to say we’re sorry.” She suggested more boosterism could go a long way. “The negative attitude of many citizens and of our government to business in general and to Amazon in particular has created an environment for Amazon and, even more importantly its employees, that is unpredictable and outright hostile,” Redman added. “This is our chance, as citizens and elected officials, to wake up and realize that Amazon is the best thing that has happened to the city in the modern era.”

Other folks have pointed out that HQ2 is a blessing in disguise, since 50,000 more Amazon employees would be hard for Seattle to absorb when we already host more than 40,000. Amazon adding a second headquaters would give Seattle a chance for its housing and infrastructure to catch up to its employment growth.

Of course, catching up will still require Seattle to do the hard work of advancing a strong housing platform. Housing Affordability and Livability Agenda (HALA) laid a strong foundation, but the City needs to go farther, both in boosting investment in social housing and in spreading growth equitably across the city–which takes zoning changes in more than just existing Urban Villages and Centers. Implementing hearty upzones with the citywide HALA rezones early next year is an important step. The Seattle City Council should follow that up with a strategy to take the growth to more neighborhoods to broaden the boom. Healthy growth will also depend on better design review policies, minimizing delays on new projects. The recent design review reform proposal gets the ball rolling, but bigger reforms are needed to fully unlock Missing Middle housing and simplify the process.

Transportation also needs time to catch up. Seattle made the investments with the 25-year Sound Transit 3 (ST3) package, but the light rail and bus rapid transit projects will take time to come online. I’ve also proposed building on ST3 with an elevated rail line to upgrade the RapidRide E–a busy bus line often bogged down in traffic–and extend to First Hill. Steps like this could help us keep ahead of our Amazon-fueled growth. Speeding up the rollout of our next seven RapidRide lines is a more immediate step to beef up transit, as is quickly rolling out the Basic Bike Network. We shouldn’t have to wait until 2020 to have a safe bicycling connection to Capitol Hill.

Where Will Amazon Pick?

The announcement included some specifications for what Amazon was seeking: “Amazon HQ2 will be the second Amazon headquarters in North America. We are looking for a location with strong local and regional talent–particularly in software development and related fields–as well as a stable and business-friendly environment to continue hiring and innovating on behalf of our customers.” Amazon also said its HQ2 would need to have at metropolitan population exceeding one million residents.

Many cities are interested. The Big Apple wants a bite, Mayor Bill De Blasio indicated. Chicago Mayor Rahn Emmanuel has reportedly already pitched the Windy City to Amazon Chief Executive Officer Jeff Bezos. Minneapolis is getting a proposal together. Philadelphia thinks it’s a prime location. Pittsburgh’s mayor was tweeting about it all day. “[Toronto] Mayor John Tory told Canada’s public broadcaster that city staffers are working on a bid,” Bloomberg reported. “We will aggressively demonstrate that Dallas and our surrounding area would be the perfect spot for [its] expansive business needs,” Dallas Mayor Mike Rawlings said. Denver’s mayor said Colorado is excited to enter the running, too.

Basically, it appears every metropolitan area that meets Amazon’s stipulation of a population exceeding one million will enter a proposal ahead of the October 19 proposal deadline. Mexico City would also be an intriguing option, with its large population and world-class Metro–but some prognosticators have eliminated Mexico since populists and racists might turn against Amazon with such a move. Speaking of populism, some viewed HQ2 as an opportunity for Amazon to revitalize a depressed region of the country. “Rust Belt cities would kill for the problems that Amazon brings,” Geekwire‘s Todd Bishop told KUOW.

Ultimately, Amazon will make a selection that works best aligns with its strategy and its bottomline. If avoiding state income taxes is a major concern for Amazon–which it did indicate a friendly business climate as a criterion–the prospect of Nevada, Texas, and Florida would be raised. Beyond that, every other major American city is in a state with a state income tax. If we are judging on the quality of transit, New York City is tough to beat, although it’s been a victim of its success lately with overcrowding. Similar goes for Washington, DC, which has also seen subway reliability issues. Boston and Philadelphia have legacy subways, too, and Chicago has the Loop.

Here's some other popular Amazon HQ2 names being thrown around not mentioned above. Which would be best fit?

— The Urbanist (@UrbanistOrg) September 7, 2017

The right combination of strong transit, a rich tech talent pool, a pro-business climate, an international airport, and affordable housing is elusive. At this point, my money is on Toronto since Amazon relies on recruiting international talent and American immigration policies have gone from paralyzed to white nationalist backlash while Canada’s remain sane and relatively open. Followers of The Urbanist seem to agree. Housing prices in Toronto have gotten pretty high, but nearby Montreal, which has relatively stable rents, could also be a strong choice if high Toronto rents spook an Amazon seeking a Canadian sanctuary city.

Seattle Booms Because Amazon Is The Master Of Platform Capitalism

Doug Trumm is publisher of The Urbanist. An Urbanist writer since 2015, he dreams of pedestrian streets, bus lanes, and a mass-timber building spree to end our housing crisis. He graduated from the Evans School of Public Policy and Governance at the University of Washington in 2019. He lives in Seattle's Fremont neighborhood and loves to explore the city by foot and by bike.